Asset ownership key to understanding class in the 21st Century

Social scientists Professor Lisa Adkins, Associate Professor Melinda Cooper and Professor Martijn Konings have spent the past 18 months researching the relationship between asset ownership and new forms of inequality, as part of the University of Sydney’s flagship FutureFix arts and social sciences research.

In a new paper published this week in Environment and Planning A: Economy and Space the researchers argue conventional ways of thinking of a person’s class as being determined by their employment status and wage are no longer adequate.

“In the present era, where mid-size homes in large Western cities often appreciate by far more in a given year than it is possible for middle-class wage-earners to save from wages, such a continued focus on employment as the main determinant of class is increasingly untenable,” said Professor Adkins.

In the paper, the researchers analyse Sydney, Australia, as a case study to examine the changing landscape of class.

“In Sydney, the past decades have seen a dramatic growth of property prices in a context where wages have, by and large, stagnated,” said Professor Konings.

“This property inflation cannot be seen as just a speculative bubble, or a result of poor policymaking – yes, it may be those things in part, but it is also a structural feature of the current phase of capitalism and has been central to the production of a new social structure of class and stratification that is characterised by a logic of its own.”

In tracing the history of Australia’s labour and wage struggles and the house price boom, the researchers also show the how certain institutions and political parties have shaped present day asset-based wealth accumulation and inequalities.

They propose that employment-based class schemes should be replaced with an asset-based scheme, which they introduce in the paper.

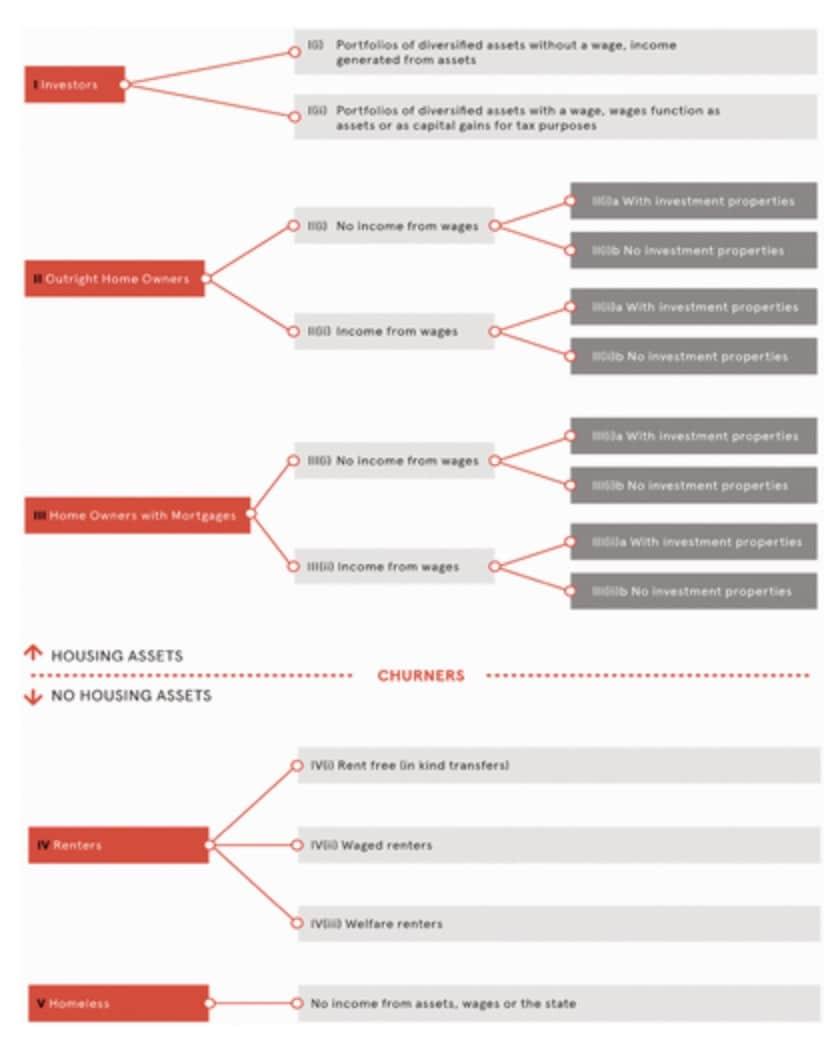

Their scheme differentiates five classes defined by their relationships to asset ownership, and especially to property ownership, as illustrated below. This ranges from investors who live off the income generated from portfolios of assets, through to non-asset owning classes such as renters and the homeless.

“Our structure identifies different relationships to asset ownership, with the top and bottom of the wealth inequality continuum moving away from each other, and renters finding it increasingly difficult to break into ownership at all, such that it is no longer possible to speak about a broad middle class,” said Associate Professor Cooper.

“While the scheme is classificatory (whereby different relationships to asset ownership define class positions), it also recognises that these classes exist in relation to one another.”

Figure above: Asset-based class scheme.

The researchers intend to develop their structure further in future work.

Declaration: The authors received financial support from the Faculty of Arts and Social Science's FutureFix programme at the University of Sydney. Additional acknowledgments are viewable on the paper.