Stakes are high as crypto dice roll in cyberspace

Not many University-sponsored conferences begin with a raffle – unless the aim of the raffle is to focus attention on a range of agenda items for subsequent discussion by delegates.

A recent University of Sydney Business School conference opened with such a raffle. It was conducted in cyberspace, the first prize was 0.2 Ether (a kind of second-generation Bitcoin) and the prize was transferred from one "smart wallet" to another.

“Ether is a currency created for Ethereum, an open-source platform based on blockchain technology,” says conference organiser David Chaikin, the head of Business Law at the University of Sydney Business School.

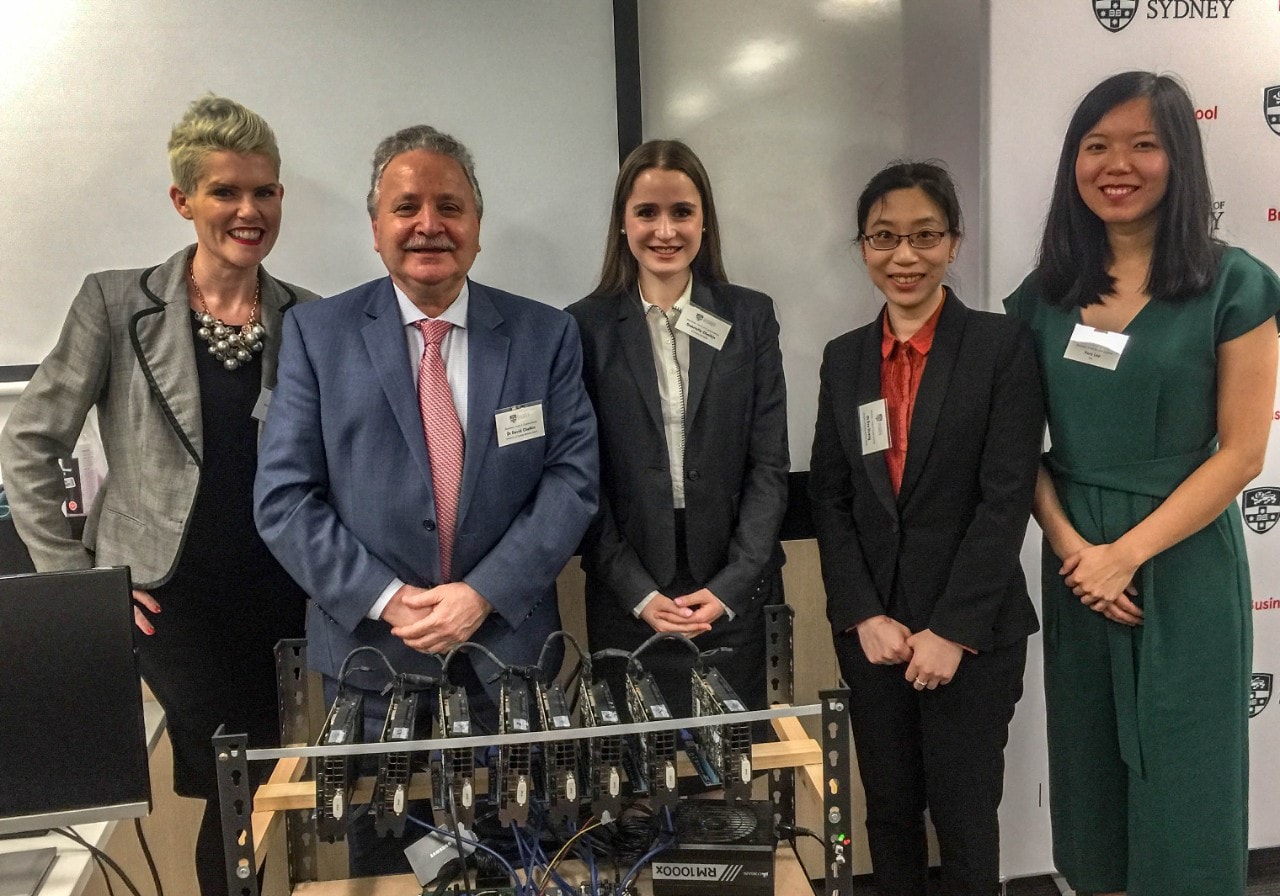

A cryptocurrency mining machine (a specialist, secure computer for processing cryptocurrency transactions) operated throughout the event, which was titled "Blockchain, Fintech and Cryptocurrencies: Business, Policy and Legal Perspectives", as if to remind delegates of the broad range of issues companies face in operating in parts of the marketplace unimagined a decade ago.

“For example, did you know it’s extremely difficult to obtain patent protection for a computer-implemented fintech invention and that inventions created by artificial intelligence, rather than a human, may lack an inventor to whom patent rights can be granted?” says Chaikin. “Start-ups may have to rely on other types of intellectual property rights such as copyright, confidential information and trade marks.”

Indeed, Chaikin pointed out that the system driving the smart wallet app used in the virtual raffle could not be patent protected.

The 75 conference attendees included representatives of Australia’s leading regulatory agencies – the Australian Securities and Investments Commission (ASIC), the Australian Prudential Regulation Authority (APRA) and the Australian Transaction Reports and Analysis Centre (AUSTRAC) – as well as operators in the fintech sector and regtech providers who specialise in technology that ensures the finance industry complies with government regulation.

The conference covered cyber investment fraud, crypto-currency risk, money laundering, taxation, the effectiveness of regtech and the ability of fintechs to disrupt the financial services sector.

One panel of experts focused on fintech and robo-advice (automated financial advice) and asked “is it more transparent, honest and reliable than human actors”? Another panel discussed crime, with speakers from England and Canada warning of the risk of manipulation of cryptocurrencies and the danger of terrorists using these new systems.

“Much of what we covered will find its way into the business law curriculum,” Chaikin says. “I plan to include practical aspects of cryptocurrency, smart wallet transfers and smart contracts in teaching next year.”

There are also plans to publish a book based on the conference proceedings.

Related news

Business School contributes to improved whistleblower protection